Tax season often arrives unexpectedly, leaving many landlords in a rush to gather documents, chase receipts, and manage financial records. As a property owner handling multiple rental units, these tasks can quickly become overwhelming. Fortunately, rental property accounting software is here to simplify the process.

Understanding Rental Income Taxation

Understanding how taxes on rental income work is critical for property owners. Rental income encompasses rent payments, security deposits not returned to tenants, late fees, and other charges. This income is considered taxable and must be reported accurately.

To manage your taxes on rental income effectively, you need to document everything clearly. Rental income is typically reported on Schedule E or Form 8825, depending on ownership structures. Accurate record-keeping involving rent payments, lease agreements, bank statements, and expenses is crucial. These details not only help in understanding how to calculate rental income for taxes but also ensure compliance and minimize liability.

Streamlining Features of Rental Property Accounting Software

Rental property accounting software offers several features that make handling taxes easier:

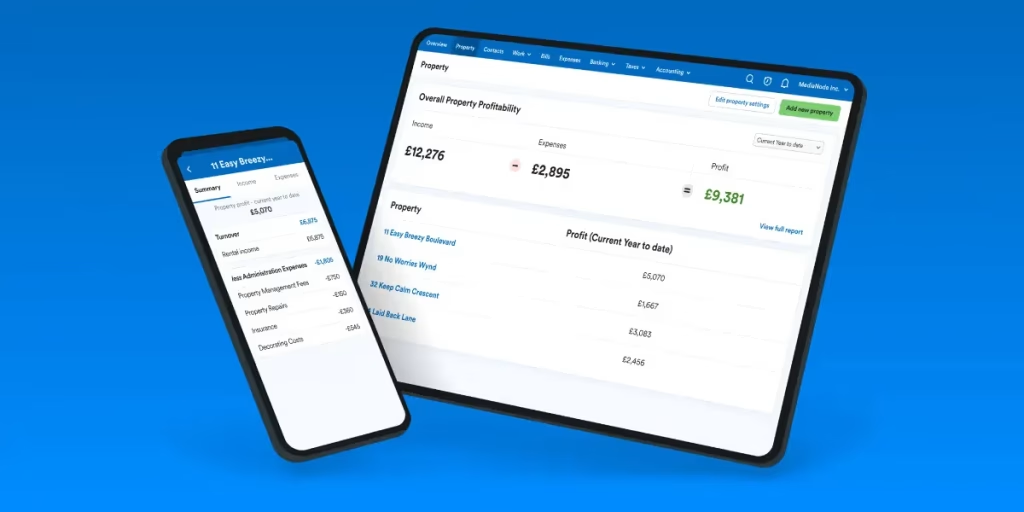

- Automated transaction tracking: The best tax software for rental property can automatically track all income and expenses. By securely linking your bank accounts, such software imports transactions directly, saving time and reducing errors.

- Budget tracking: Tailored budget tracking helps you manage finances without the stress of manually organizing records. You can quickly assess spending, helping you allocate resources more efficiently.

- Record storage: Having a centralized, digital storage system for all records and transactions simplifies organization. Many platforms support importing existing data, ensuring a smooth transition.

- Custom organization: Software solutions allow for detailed customization, helping you organize finances across various properties, units, and tenants. This makes spotting trends and anomalies easy, providing insights into financial performance.

- Accessibility: The convenience of accessing your financial data from anywhere ensures you can manage your tax affairs on-the-go. User-friendly interfaces make these tools accessible even to those with minimal accounting experience.

Generating Tax Forms

Worried about how to calculate rental income for taxes? Many rental property accounting solutions are integrated with tax software, automating the creation of necessary documents. Platforms like Ledgre compile the information required for Schedule E, covering income, expenses, and deductions. While it’s important to double-check these entries, such software is generally reliable and precise.

Rental Property Tax Deductions

An essential benefit of using tax software for rental property is the ability to easily manage deductions. Taxable income can be reduced by claiming various expenses, including:

- Mortgage interest and property taxes

- Operating expenses (utilities, maintenance)

- Depreciation and amortization

- Travel expenses related to property management

- Professional fees for legal, accounting, and management services

- Advertising and insurance premiums

Proper documentation is necessary to claim these deductions effectively. Consulting with a tax professional ensures you maximize your deductible expenses.

Conclusion

As tax season approaches, leveraging the right tools can make a significant difference. The best tax software for rental property, integrated within your accounting system, simplifies the intricacies of taxes, budgeting, and organization. By fully utilizing these features, managing your financial obligations becomes less daunting and more efficient. Embrace technology to transform your tax season experience, ensuring accuracy and compliance while freeing up valuable time to focus on growing your property investments.